Signs for FinTech Startups to Leave No-Code

- Deval Patel

- Feb 9, 2026

Your MVP was created in three weeks using Bubble, Airtable, and some Zapier automations. Total spend: under $500. It was like finding a cheat card to a first time FinTech founder. No backend team. No long sprints. Just drag, drop, and ship. The very first users registered, demos were successful, and investors said yes with their heads.

Your initial spurt of growth came along. A marketing campaign worked. One of the partners became active. In a flash, there were 1,000 simultaneous users clicking on the “Transfer” and refreshing dashboards and initiating workflows at the same time. Pages slowed. Automations queued. Transactions lagged. Support tickets piled up. The superpower began to resemble a post-drunk.

The bad news about that is that no-code is not an irreversible basis. It’s a rented scaffold. It is perfect to check an idea, demand, and prove that someone is interested. However, it is a high-stakes game in FinTech where money flows, regulation looms and trust is key, and renting your core logic becomes a very risky decision.

This is where most founders do not see the custom software discussion. Leaving no-code is not a move of pursuing more features or developing something fancy because of engineering vanity. It’s about ownership. Being the owner of your intellectual property. Owning your data. Being in control of your architecture when a regulator, bank partner or due diligence team begins to pose uncomfortable questions. Buzzword Scale Custom software Custom software is not a buzzword but a matter of survival as a serious FinTech company.

Turn your MVP into infrastructure you actually own

Get a No-Code Exit Plan

3 Signs for FinTech Startups to Leave No-Code

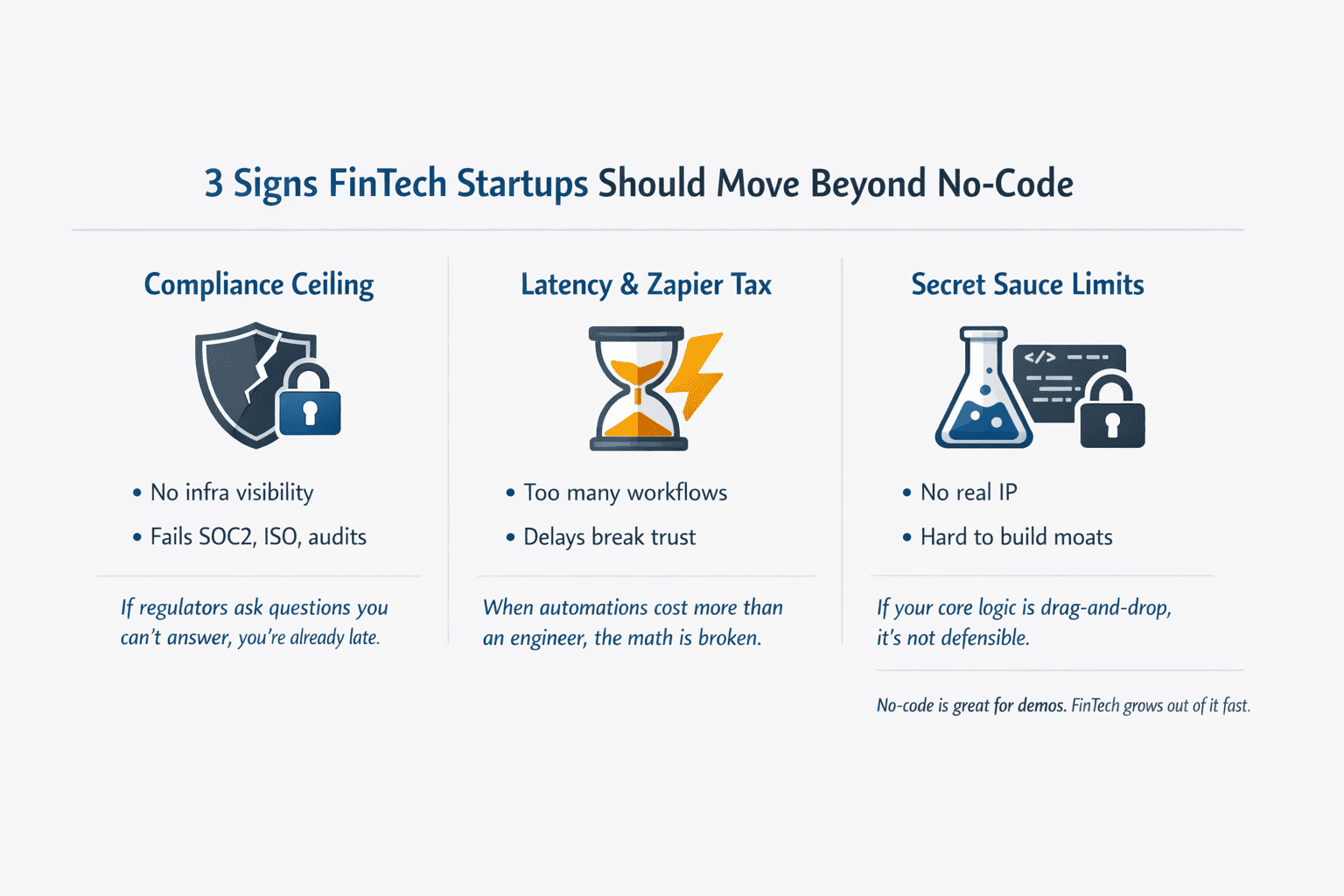

1. The Security and Compliance Glass Ceiling

NOC foundations seem to be the first big split when security and compliance come in the room. In general, most no-code platforms are black boxes. You have no control over the infrastructure behind. The implementation of encryption in transit or at rest cannot be inspected. You are not aware of the physical server sharing of all the physical servers with you, or the actual real-life performance of incident response.

However, this is seldom important in early demos. However, FinTech does not remain early long enough.

Once you have begun speaking to Tier-1 banks, payment processors or even enterprise clients the discussion becomes different. You find yourself being questioned on SOC 2 Type II reports, ISO certifications, data residency and penetration testing. The response of using Bubble or our workflows are based on Zapier is not an assuring response, but usually the quickest solution to lose the deal.

Experienced founders acquire this through experience. It does not matter how fast you shipped your MVP by regulators and risk teams. They are concerned with control, accountability and auditability. People would like to understand the location of customer data, the people who can access it, and the way of preventing breaches and how they can be addressed. In case your platform provider is not able to provide you with a dedicated instance or a Virtual Private Cloud (VPC), then you already hit the glass ceiling of compliance.

The response that can be taken today that is brutally simple is to audit the compliance documentation of your no-code vendor. Not the marketing page, but the actual reports. The fact that you are unable to obtain straight answers to data isolation, logs regarding access, or bespoke security measures, is indicative of you pushing the platform to its limits, or at least you soon will be.

2. The Zapier Tax and Latency Bloat

No-code processes are initially magic. A user clicks a button. An API fires. Another service responds. A notification is sent. None of them even wrote the first line of code. However, all the magic comes with a price in FinTech- the price is usually latency and fragility.

Picture a common scenario. A user initiates a transfer. Such a move initiates a workflow of no code. The payment API is called in the workflow. The answer is posted into a webhook. It is picked up by Zapier, processed by it, adds to a database and it then activates a notification service. A single click would be four or five distinct systems communicating with each other, as an example, via a third-party integrator.

In the majority of consumer applications, a half-second delay is irritating. Where FinTech is concerned, 500 milliseconds is a lifetime. The balances are expected to update immediately. The merchants want real-time confirmations. Delays erode trust fast.

Worse these chains add silent technical debt. When the business logic relies on a chain of third party connectors, one API change will result in a partial or complete system failure. A rate limit, a webhook delay, a provider outage - and your core flows fail.

This has a real-life warning. One neo-bank startup have found out that its Instant Notifications were four minutes behind schedule during the busiest times of the day. Why? They had to wait in a queue of almost 10,000 events in their webhook on a common automation platform. It appeared to the user that the bank was not working. Everything was properly configured inside.

The indicator is quantifiable. Monitor your task or run based billing. You have waited too long to migrate when your monthly bill to Zapier or Make.com is giving you the impression that it is as expensive as the wages of a senior developer. By then you have to pay a premium price on slowness and risk.

3. The Secret Sauce restriction

No-code would be all well when you have superficial competitive advantage. A cleaner UI. Faster onboarding. A niche market focus. However, not all founders of FinTechs are creating lifestyle products but creating defensible businesses.

In case you are strong on proprietary credit scoring or real-time risk models or fraud detection logic or high-frequency ledgering, no-code is a tough limit. The use of drag-and-drop editors does not support complicated algorithms, performance-intensive calculations, and highly tailored data models.

This is not just an issue of technicality - it is an issue of strategy. It is impossible to copyright or safeguard processes that are developed on a platform of another individual. Investors look for moats. They would like to possess intellectual property, which you own and control. Custom code is a moat. No-code subscription is at best a luxury and at worst a burden.

It ceases to be a secret when your secret sauce is inside one of the platforms shared by thousands of other startups. When this occurs, it becomes superficial and readily imitable.

The Economics: When Cheap is Expensive

No-code is cheap as it is cost-effective at the very beginning. However, FinTech economics do not scale. The more it is used the higher the per-user costs, per-record costs and per-task costs. It begins with $50 a month and gradually grows into thousands.

An easy comparison can be considered:

- Scalability: No-code increases the cost per user and transaction. Custom systems are based on comparatively flat infrastructure expenses.

- Flexibility: The no-code features are restricted through updates by vendors. Custom builds develop on your roadmap.

- Data Ownership: No-code typically entails export-only access and vendor lock-in. Custom software provides complete database access.

Your cost per transaction is the most viable measure to monitor. When it does not reduce the cost when you go big, your platform is cannibalising your margins. By this time, cheap is not cheap anymore it is disguised.

This does not have any code of hangover. And this realization can come early enough to prevent the later migration and an existential crisis to come later on.

Know your real cost per transaction before margins disappear

Calculate My FinTech Unit EconomicsThe Transition Strategy: Rip and Replacement

When founders come to the realization that no-code has reached a ceiling, the natural response is usually a panic-attack, What the hell should we do again? Such an attitude is very costly, hazardous, and most of the times unnecessary. The smarter FinTech teams do not roll and replace, but change slowly.

The trick here is knowing that you should not put the same amount of engineering effort in every single component of your product. The decision to permit regulators to approve of you, and investors to appreciate you is not the effort of your marketing site, blog, internal dashboards and lightweight CRM workflows. Your core financial logic is.

The Hybrid Approach, Which works in the Real World

A logical transition plan is pragmatic in nature. Retain that which works on no-code and surgically replace that which does not.

The marketing site that everyone can see can move forward on Webflow or the like. Your CRM, internal applications, and straightforward reporting processes do not need to move. Such systems are not risky and are not often performance-sensitive.

But your core must move. The ledger. The transaction engine. User authentication. Permission systems. Anything that has any touch with money, balances, or other sensitive PII must reside in a dedicated backend that is under complete control.

The most common backend stacks used in this layer by most FinTech teams are either Node.js to run loops quickly, Go to be fast, and concurrent or Python to run logic and analytics heavy on data. The point is that the language is not important, but the principle is: this backend is yours. You are in charge of the flow of data, execution of logic and scaling of systems to accommodate pressure.

This is a hybrid model that minimizes risk on either side. You do not slow down growth by rewriting non-critical aspects, and you do not put at risk trust by placing financial reasoning in a black box.

The Build Headless First: The MVP of Custom

The other pitfall that founders commit is the attempt to reconstruct the whole product, frontend, and backend simultaneously. It does not need to do that very often and tends to be counterproductive.

It is best to begin with a headless backend. Consider it as the minimum viable core. Your in-house system reveals APIs of authentication, transactions, balances and audit. It is not interested in the prettiness of the interface. It is not concerned about the correctness, performance, and security.

At this stage, you can keep using your current frontend with no-code. It just provides communication with your custom backend through APIs or webhooks. To the user, nothing will be different. Everything does, in your view of architecture.

This approach buys you time. You are able to test your new backend with real-world traffic. You can run parallel systems. Migration of workflows can be gradually done without a fear of a big bang launch. Above all, you will be able to demonstrate to investors and other partners that you are actively de-risking your platform.

A single tip that could be considered practical is that you need to begin your custom build at least half a year before you believe you will reach the limit of the platform. Founders always underestimate the time it will take to migrate, in particular in regulated environments. Early start is what makes a crisis a manageable evolution.

Build a regulator-ready backend without breaking your product

Start With a Headless FinTech BackendConclusion

At least by 2026, the no-code argument in FinTech is settled. There is nothing to fight no-code, or anything to be proud of with custom software. At various stages, they have different purposes. The barebone is as follows: no-code is to be validated, custom code is to be valuated.

No-code assists you in showing that an issue exists and users have the interest to invest in solving the problem. High-quality custom software can make you demonstrate that your company can be trusted with money, data, and regulatory examination. One gets you to market fast. The other keeps you there.

Trust is the one and only currency in FinTech. Customers entrust you with their savings. Partners put their faith in you with integrations. Systemic risk is left in your hands. The trust will not be fully outsourced. When you do not own your code, you do not completely own that trust--and sooner or later somebody will realize.

FAQs

1. Does no-code offer sufficient protection to FinTech?

Yes, in the case of a prototype. To process live customer money and sensitive PII in large amounts? Rarely.

No-code platforms may work well during initial testing and demonstrations, but cannot provide the fine-grained security measures, auditability, and separation needed to make decisions that involve serious financial transactions. It is not only technical risk, but it is regulatory and reputational risk.

2. What is the cost of the migration between Bubble and custom software?

Short answer A modular migration would normally begin in the range of $20,000-50,000 (with more complex financial logic).

It becomes expensive when you want to completely rebuild rather than have a gradual transition. Headless backend is the cheapest way a lot of times.

3. What is the most appropriate time to change?

Short answer: Once you get to the point of around 5,000 active users, or once you start seeking a financial license, namely, an EMI or banking license.

Latest Articles

Browse All Articles

- Custom Software

- Feb 16, 2026

Top Software Development Companies for Franchise Businesses (2026)

Looking for the best software development companies for franchises in 2026? Explore our ranked list of top-tier developers building the future of franchise tech.

- Custom Software

- Feb 15, 2026

Top Custom ERP development Companies in Ahmedabad

Explore the top custom ERP development companies in Ahmedabad, offering tailored ERP solutions to streamline business processes, and boost efficiency.