FinTech Software: Buy vs Build

- Deval Patel

- Feb 9, 2026

In 2026, building a FinTech is not about building a ledger. It is about building trust, speed, and a customer experience that feels invisible when it works. Yet many founders still spend their earliest months trying to recreate standard payment rails, KYC flows, or account ledgers that already exist and work well.

This usually comes from a real fear: if we do not build it ourselves, do we really own the product? Add to that the pressure of compliance requirements like PCI-DSS, SOC 2, GDPR, and region-specific financial regulations, a reality common in financial software development, and the decision quickly becomes emotional instead of strategic.

The truth is simpler and less dramatic. “Build vs. Buy” is not a binary choice. The strongest FinTechs follow a modular strategy. You build your secret sauce. You buy the commodity plumbing. Everything else sits somewhere in between.

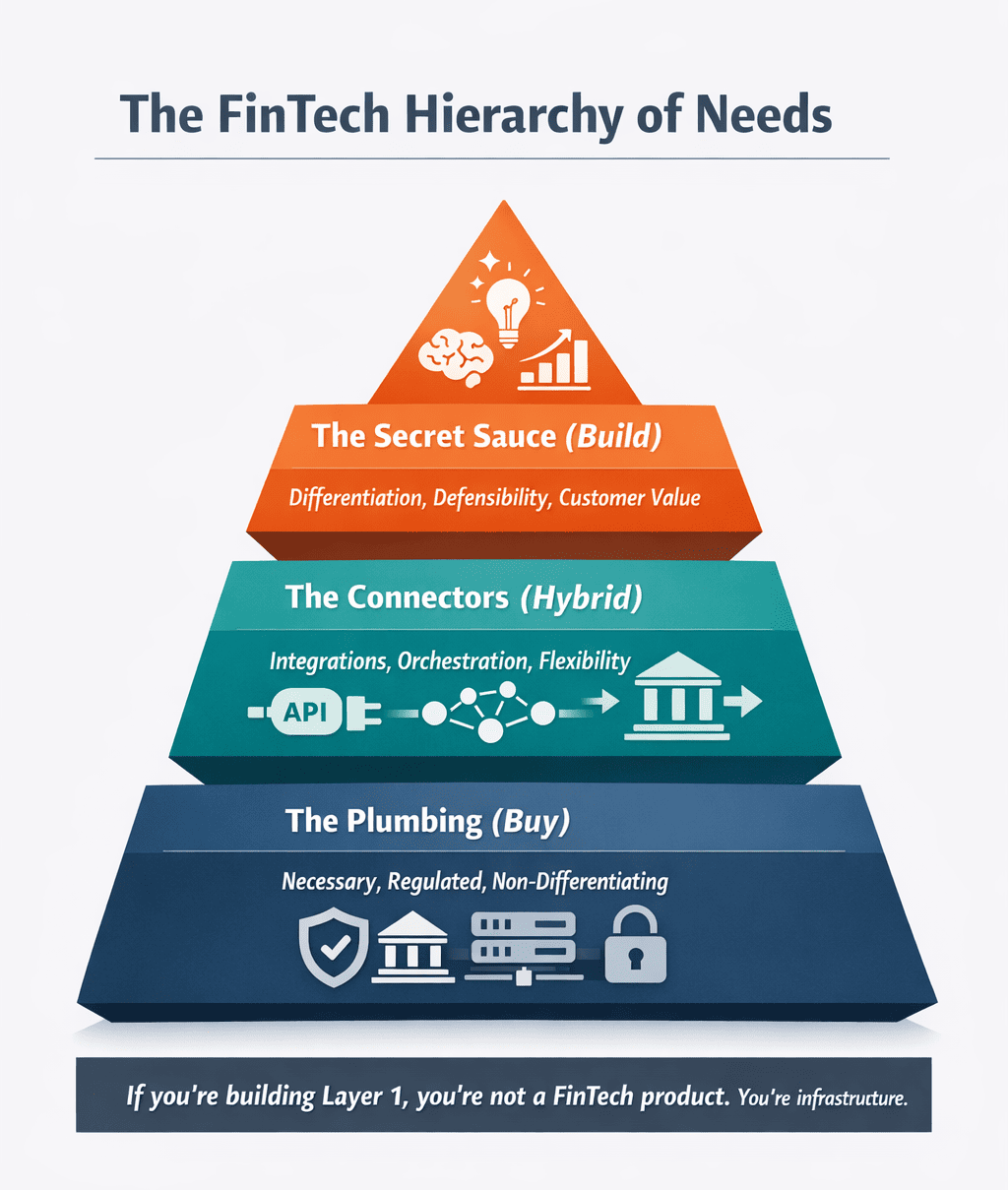

The FinTech Hierarchy of Needs

Founders should have a clear mental model of the product layer to make better decisions about FinTech products. Imagine your product as a three-layer hierarchy, each of which has to be approached differently to build or buy.

Layer 1: The Plumbing (Buy)

Any FinTech product is based on this. It includes:

- KYC and AML verification

- Settlement railways and payment gateways.

- Core banking ledgers

- A cloud infrastructure and security tooling.

These parts are extremely controlled, standardized, and heavy to operate. They are necessities, but not differentiators. Established players in this market have years of security hardening, regulatory compliance, and international scalability. Reinventing this layer is not likely to provide a competitive advantage; it just reproduces existing infrastructure at an increased risk and expense.

Layer 2: The Connectors (Hybrid)

This layer is located between your product and the financial ecosystem. It contains APIs and integrations that connect with banks, credit bureaus, payment networks, and open banking systems, including Plaid or other regional equivalents.

In this case, a hybrid solution can usually be effective. It has an API access or base integration, which you may purchase, and custom orchestration, data normalization, or fallback logic, which you may create around it. This will provide flexibility and will not take on all the compliance and maintenance costs.

Layer 3: The Secret Sauce (Build)

Here, in this differentiation, you will find yourself:

- Risk or proprietary models of underwriting.

- Original UI/UX and onboarding processes.

- Artificial intelligence, personalization, or wealth management logic.

This layer has a direct influence on customer value and defensibility in serious FinTech software development, where differentiation must be engineered deliberately. When competitors can substitute it with a different vendor, then it is not a moat. This is the layer that you are supposed to vigorously build, rework, and guard.

Writer’s Note: In case you are Layer 1, and you are writing it yourself, you are not a FinTech startup; you are an infrastructure company. Infrastructure businesses are potentially lucrative, with a totally different capital structure, schedule, and tolerance to risk than most product-led FinTechs expect.

Most FinTech problems start with the wrong layers

Get a Layered Product ReviewThe Real Price of (Hidden) 2026 Benchmarks of Building

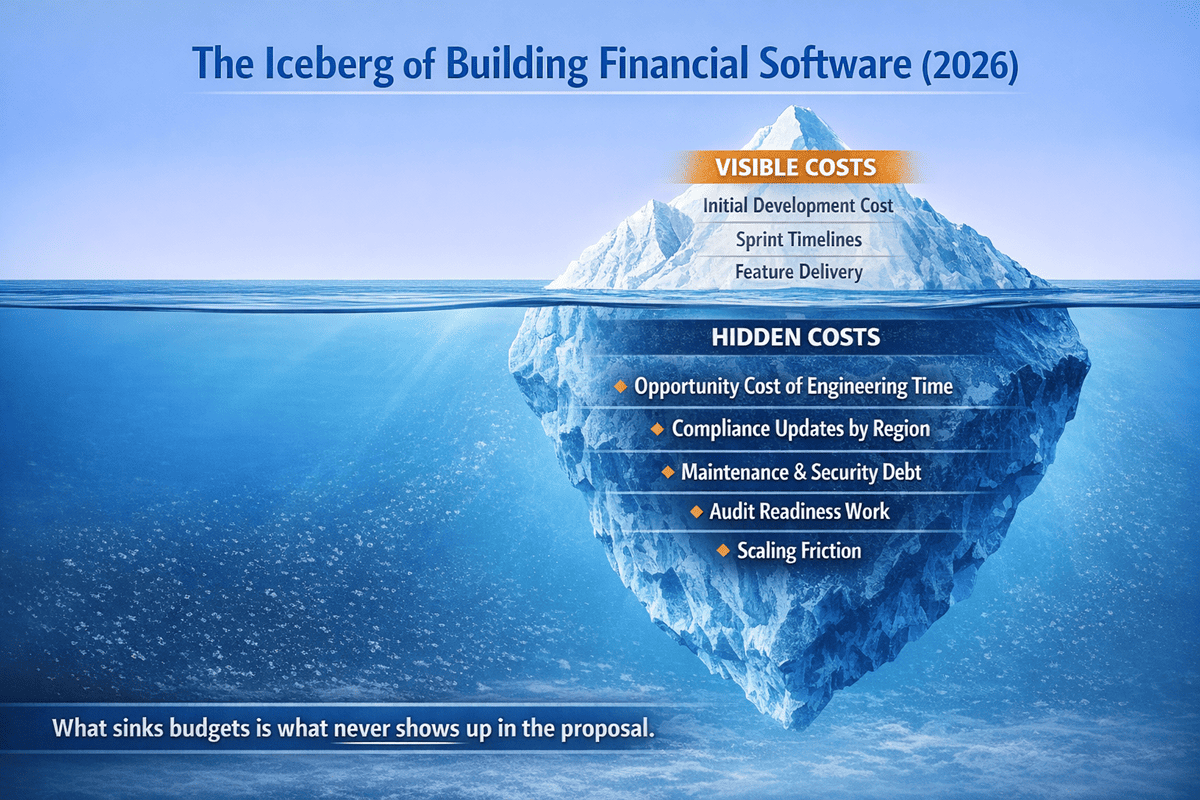

Numerous founders overestimate the actual cost of developing financial software due to their lack of consideration of development time only. As a matter of fact, the biggest expenses come post-launch.

Costs of opportunity within engineering

The most limited resource is engineering time. When one of your top engineers takes four months to develop a bespoke KYC flow, look further: What were they not building for the customer in that period? Activation improvement features, churn reduction features, and lifetime value enhancement features are frequently deferred on the basis of teams being preoccupied with resolved issues.

The Compliance Tax

Financial modules that are custom-built must be updated regularly for compliance. The regulations vary by region, audit standards vary, and reporting requirements increase. All internal systems will turn into an obligation in the long term to track changes in the legal framework and adjust workflow to the changes. This compliance tax only adds up and is seldom reflected in the project estimates.

Maintenance Debt

A build will not be a one-time expense. To be conservative in 2026, the founders need to plan on spending 20-25 percent of the initial cost of the building on maintenance. This involves bug fixes, security patches, performance tuning, and compatibility updates. The failure to account for this fact results in systems that are weak enough to slow down the business when scale eventually comes.

The Risk of acquiring

Purchasing is not a risky affair either. Although it is a speedy time to market, it also creates strategic dependencies that can only be managed proactively.

The Roadmap Trap

The stagnation of your growth may take place when a third-party provider does not develop. As an example, a new rail, such as the FedNow or emerging CBDC standards, may not be supported by your payment provider, so your product roadmap will be at the mercy of theirs. What was a shortcut may become a bottleneck.

Unit Economics at Scale

The majority of the Buy solutions are charged on a transaction or a user basis. At 1,000 users, these fees would be insignificant; at 1,000,000 users, they can be disastrous. Long-term unit economics: Founders must model long-term unit economics early enough so as not to get unpleasant surprises as they scale up.

Data Sovereignty

The data ownership must not be negotiable, even when it comes to purchasing it. You also need to make sure that you are able to export, migrate, and audit customer data separately. Ease in doing business with the vendor must not be at the expense of losing control of your most prized asset: data.

The Decision Matrix: 4 Questions Founders need to ask

Founders still need to make dozens of micro build-vs-buy choices despite having frameworks and benchmarks. FinTech teams must be careful to ensure that a basic but strict decision matrix is applied to each of the core elements to eliminate the possibility of emotional or ideology-inspired decisions.

The Build vs. Buy Decision Matrix

| Question | If the Answer Is YES… | If the Answer Is NO… |

| Is this a competitive advantage? | Build | Buy |

| Is this a regulated commodity? | Buy | Build |

| Can we afford a 6-month delay? | Build | Buy |

| Does an API already exist for this? | Buy / Integrate | Build |

This matrix is used as a practical filter of architectural decisions along the product roadmap. Instead of reducing to instinct, like the urge to own everything or the urge to ship fast, it compels the teams to appraise every component in varying ways, regulatory exposure, and time-to-market. Providing you have systems that directly boost your moat or customer value, then it is worth developing. If it is commoditized and highly regulated or even already provided in mature APIs, purchasing is the more strategic choice in most instances. This framework is applied uniformly so that engineering effort is put on areas where it has the most long-term business impact.

Case Insights: When It is Time to Pivot

The most effective founders of FinTech do not consider Build vs. Buy a one-time question. They consider it a living strategy- one that is scaled, regulated, and has unit economics. It is not in making the right choice on the first day, but when to turn it around as the business grows.

Case A: Outgrew Socket Case of the Neobank

Take an example of a digital neobank entering a highly regulated market. Speed back in the early days was existential. The licensing process was fast, the expectations of investors were great, and the competitors were opening up every quarter. The founders made a sensible decision: they purchased a Core Banking System (CBS) offered by an established vendor.

This ruling enabled them to live for less than 90 days. The CBS dealt with the account creation, posting of transactions, reconciling, regulatory reporting, and audit logs. Although the licensing charges were substantial, the trade-off was evident: quicker market entry, less risk of compliance, and instant recognition amongst the regulators and partners.

But the success brought about another issue. Once the neobank reached the period of over 500,000 users, transaction volumes jumped. That previously seemed like a manageable per-account and per-transactions fee structure started to have a significant margin-related impact. Flexibility of products was also a problem now; it was necessary to wait until the vendor added new account types or pricing experiments to the roadmap.

The team did not rip everything out and instead made a strategic pivot. Instead, they maintained the CBS as the controlled system of record but constructed a new layer of transaction orchestration, a bridge that did routing, fee optimization, and internal accounting logic. This mixed solution minimized variable expenses, revived product agility, and prevented the nuclear solution of re-creating an entire core banking ledger out of nothing.

Insight: Purchasing at a young age gave them time. They were acquired later by Building Leverage.

Case B: The Lending Platform That Built Only What Matters

Now fill in a digital lending platform that is involved in consumer credit. Since its inception, the founders were straightforward as to their differentiation: smarter credit decisions, based on alternative data, to underbanked users. This reasoning, how risk was evaluated, priced, and accepted, was their Secret Sauce.

They spent a lot of money constructing their own credit scoring and underwriting engine. All the data pipelines, machine learning models, decision rules, and explainability layers were in-house. This system was developed at a very fast rate according to the repayment behavior and risk patterns in the regions. No off-the-shelf vendor would have brought the same strategic value.

However, as far as the flow of money was concerned, loan advances and loan payments, the group made a completely different choice. They directly became part of Stripe and other payment processors to process transfers, cards, and settlements. These elements were standard, controlled, and non-differentiating.

The platform was faster, easier to audit, and scale without causing chaos in operations by decoupling decision intelligence and financial plumbing.

Understanding: To create differentiation, there is no need to develop everything. It entails savage precision on what actually makes you different.

Your FinTech won’t fail the same way, but the patterns repeat

Talk Through Your Use CaseThe Trend 2026: The Headless Middle Ground

By 2026, there is an evident halfway between full construction and full purchase: Headless FinTech architecture.

In this model, startups purchase a modular backend platform, such as payments, compliance logic, account management, or lending engines, and keep complete control over the frontend experience. Consider it as the purchase of the engine and creation/ownership of the dashboard.

Reasons Headless is Gaining Momentum.

Conventional all-in-one FinTech platforms tend to trade flexibility for rigidity. You have a quickly available work product, although your UI, workflows, and even feature sequencing are limited by vendor assumptions. Headless APIs reverse this model.

Founders can:

- Completely design onboarding and UX flows.

- Customer interaction and control branding 100 percent.

- Replacement providers of swaps without redesigning the front end.

- Learn more quickly through experience without interacting with controlled systems.

This strategy is ideal for customer expectations in the contemporary world. The onboarding flow of a product is not judged by users against the onboarding flow of a bank; it is judged against the best consumer apps that people use daily.

Non-UX Strategy Benefits:

- Architecture without heads is not only a question of beauty. It is a risk management approach.

- Regulatory isolation: API heavy logic that is behind a low blast radius.

- Vendor optionality: You can really escape deep lock-in by decoupling your own interface from the providers.

- Quickened experimentation: New functionality can be experimented with by the UI or logic layer without regulatory re-examination.

- This model provides a strong balance to the founders who need to be fast and gain control at the same time.

- Major Paradigm Shift: Build or Buy is long gone, Compose is the Future.

Move fast without surrendering control

Design a Headless FinTech StackConcluding

The Build vs. Buy debate is all about a single measure, Time to Value (TTV). How fast can your product create significant value to customers, confirm demand, and create learning?

The Final Verdict

At the initial phase of a FinTech startup, TTV is nearly always considered to be more important than IP ownership. It does not matter whether you have all the lines of code, because you lose track of the runway before product-market fit. Acquiring mature elements enables founders to concentrate on what is most important, which is customer issues, optimizing pricing, and creating trust.

As the company grows, the equation changes. Margins matter more. Control matters more. Tactical buys are being supplanted by strategic builds. It is a healthy evolution--and a natural progression.

A Final Advice to Founders

Most of the founders of Fintech are the builders. It takes pride in creating systems on its own. But effective founders understand how to put ego aside.

Do not let being a builder come between you and being a founder. It is not about how many lines of code you write, but it is about what kind of valuable company you create.

Build your Secret Software. Buy your Commodity Plumbing. But most of all, maximize Time to Value.

Latest Articles

Browse All Articles

- Custom Software

- Feb 16, 2026

Top Software Development Companies for Franchise Businesses (2026)

Looking for the best software development companies for franchises in 2026? Explore our ranked list of top-tier developers building the future of franchise tech.

- Custom Software

- Feb 15, 2026

Top Custom ERP development Companies in Ahmedabad

Explore the top custom ERP development companies in Ahmedabad, offering tailored ERP solutions to streamline business processes, and boost efficiency.