CoreWeave Statistics You Need to Know (2026)

- Deval Patel

- Jan 13, 2026

Something SUPER special happened in 2017.

Three commodities traders—Michael Intrator, Brian Venturo, and Brannin McBee—bought their first GPU to mine Ethereum in a garage in New Jersey. They weren't trying to build a cloud empire; they were just chasing crypto arbitrage.

Fast forward to 2026, and CoreWeave isn’t just another cloud provider. It is the backbone of the AI revolution. Following its landmark IPO in March 2025, which saw its valuation soar to over $23 billion, CoreWeave has cemented its status as the world’s first "AI Hyperscaler."

For context: it took legacy providers like AWS and Azure decades to build their infrastructure moats. CoreWeave blew past them in record time, amassing a fleet of NVIDIA GPUs that powers the world's largest AI models, including ChatGPT.

But the story doesn’t end there. In late 2025, CoreWeave solidified its "power-first" strategy by acquiring Core Scientific in a $9 billion deal, securing a massive 1.3 gigawatts of power capacity. Despite a volatile market in early 2026, the company remains the primary engine for the Blackwell chip era.

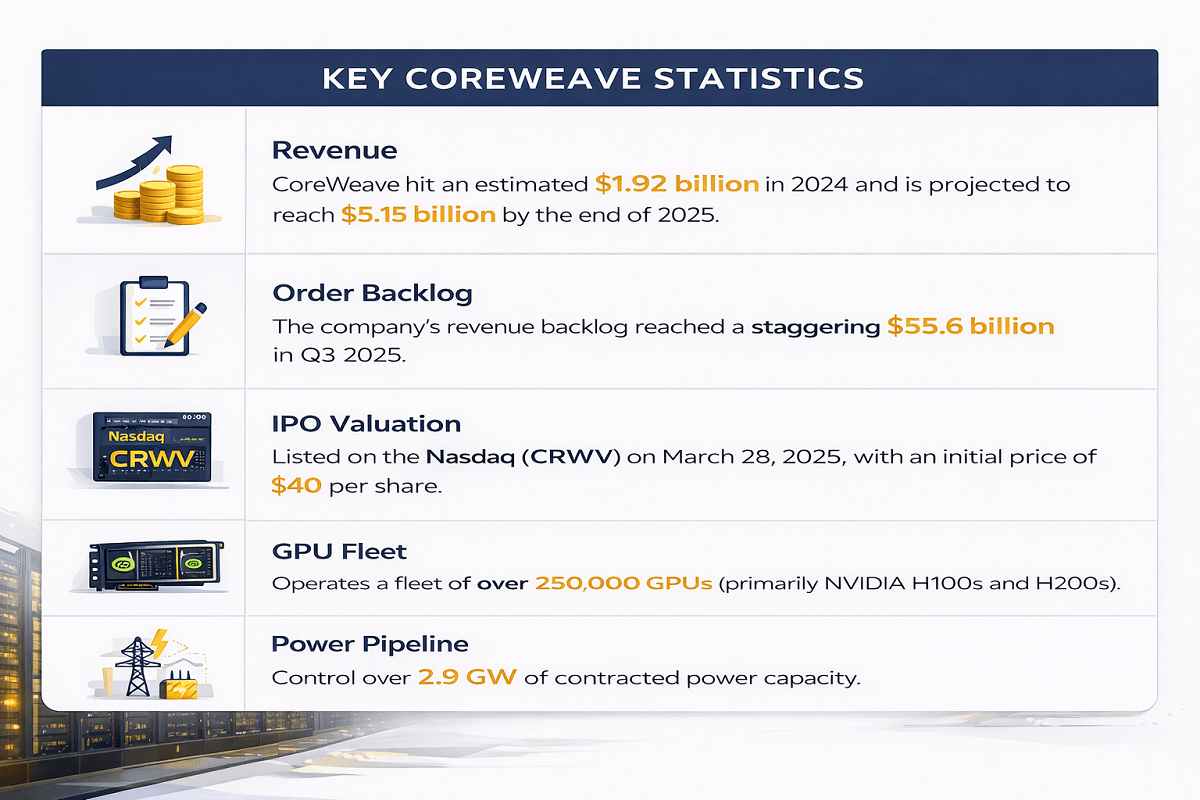

Key CoreWeave Statistics

- Revenue: CoreWeave hit an estimated $1.92 billion in 2024 and is projected to reach $5.15 billion by the end of 2025.

- Order Backlog: The company’s revenue backlog reached a staggering $55.6 billion in Q3 2025.

- IPO Valuation: Listed on the Nasdaq (CRWV) on March 28, 2025, with an initial price of $40 per share.

- GPU Fleet: Operates a fleet of over 250,000 GPUs (primarily NVIDIA H100s and H200s).

- Power Pipeline: Control over 2.9 GW of contracted power capacity.

CoreWeave Revenue and Growth

CoreWeave’s financial ascent is unprecedented. The company transitioned from a crypto-mining operation to a multi-billion dollar AI giant in under five years.

According to the latest filings, CoreWeave's revenue grew by over 730% in 2024 alone. While the company still reports net losses due to massive capital expenditures, its "adjusted" earnings tell a story of rapid scaling.

We’ve charted CoreWeave’s revenue growth since 2022:

| Date | Annual Revenue | Valuation/Market Cap |

|---|---|---|

| 2022 | $15.83 Million | $2 Billion (Series B) |

| 2023 | $228.94 Million | $7 Billion (Tender Offer) |

| 2024 | $1.92 Billion | $23 Billion (Secondary Sale) |

| 2025 (Projected) | $5.15 Billion | $38 Billion (IPO Peak) |

CoreWeave Total GPUs 2026

As of early 2026, CoreWeave operates a fleet of over 250,000 GPUs, primarily consisting of NVIDIA H100 and H200 chips.

Year | Estimated GPU Count | Key Hardware Additions |

|---|---|---|

2022 | >17,000 | Pivot from Ethereum mining (A100s) |

2023 | 53,000 | Massive H100 "Hopper" intake |

2024 | ~250,000 | First-to-market with H200s |

2025 | 250,000 | Deployment of Blackwell (B200/GB200) |

2026 (Est.) | 500,000 – 800,000 | Integration of GB300 NVL72 systems |

Sources:Sacra, CRN, Capital.com

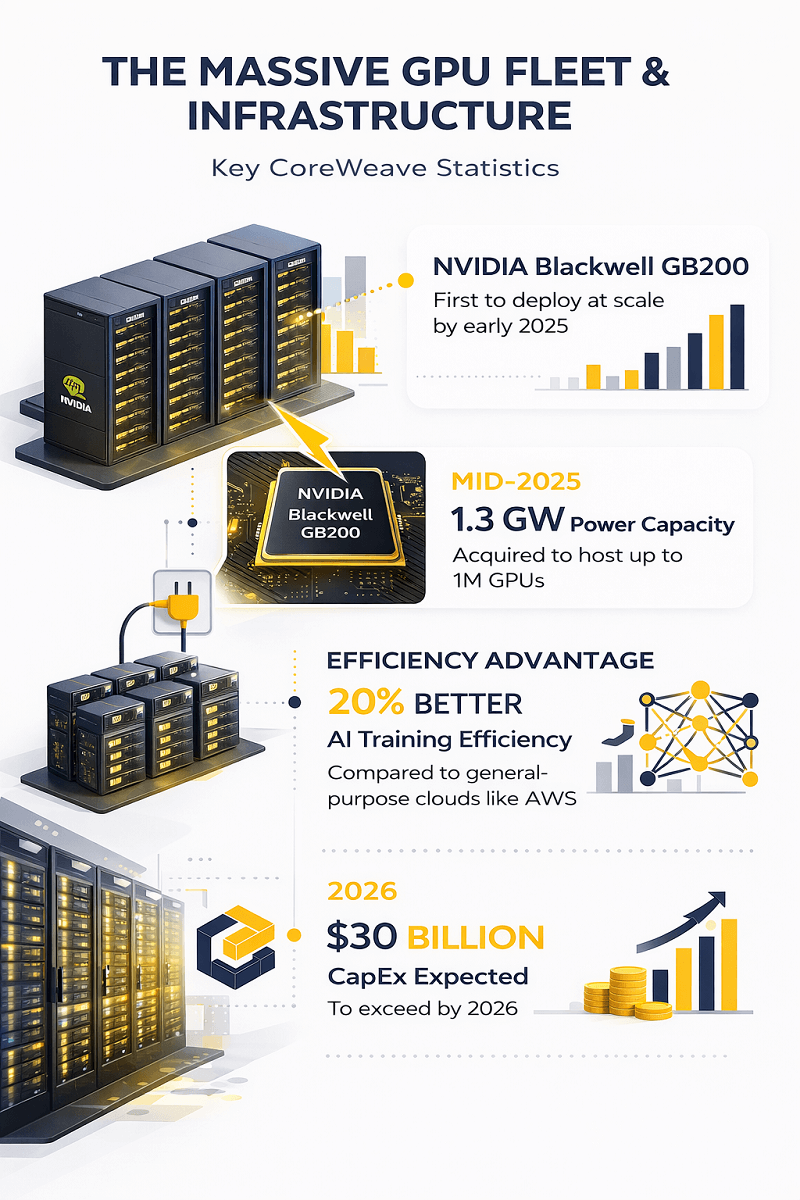

The Massive GPU Fleet & Infrastructure

CoreWeave's primary asset is its massive stockpile of high-performance NVIDIA GPUs. By early 2025, they were among the first to deploy the NVIDIA Blackwell GB200 clusters at scale.

- The Power Pivot: In mid-2025, CoreWeave acquired Core Scientific to verticalize its expansion, gaining control of 1.3 GW of power capacity—enough to host up to 1 million GPUs over time.

- Efficiency Advantage: CoreWeave claims its specialized architecture provides 20% better computational efficiency for AI training compared to general-purpose clouds like AWS.

- Infrastructure Spend: To keep pace with demand, CoreWeave’s capital expenditure (CapEx) is expected to exceed $30 billion in 2026.

Sources:The Next Platform, Fierce Network, MLQ.ai

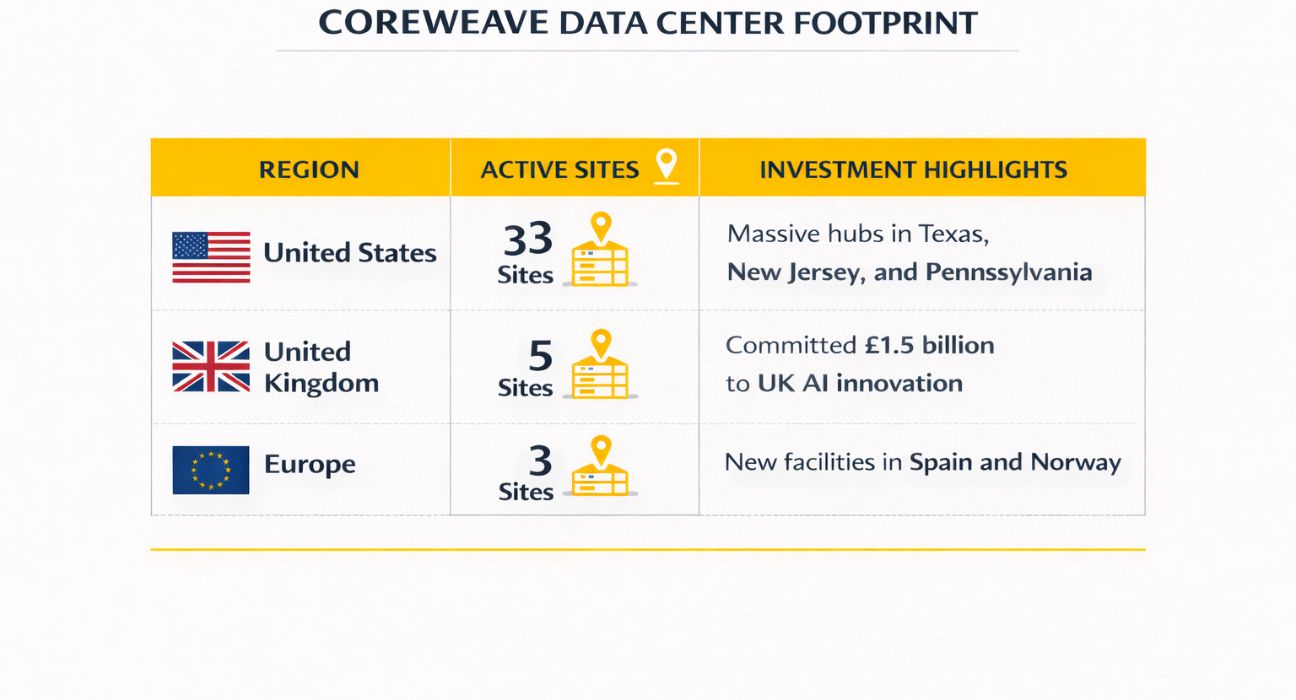

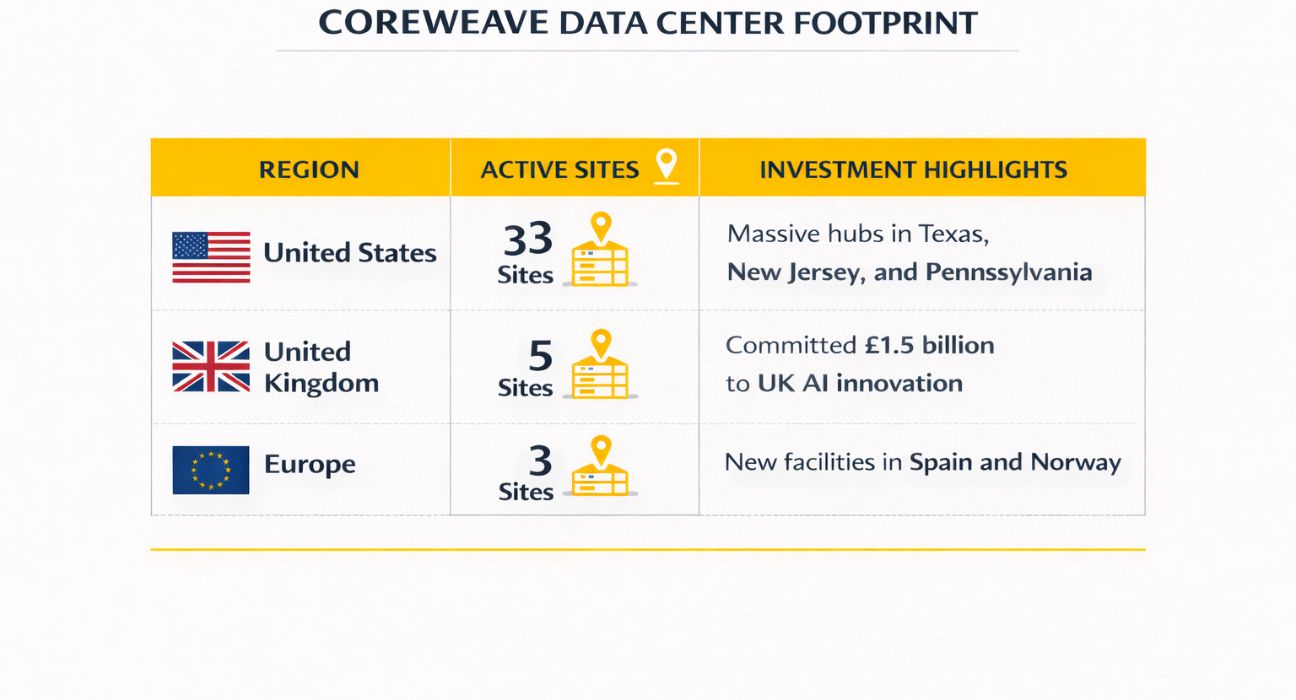

CoreWeave Data Center Footprint

To accommodate the demand for AI inference, CoreWeave has expanded its physical footprint to 41 active data centers globally as of late 2025.

| Region | Active Sites | Investment Highlights |

| United States | 33 Sites | Massive hubs in Texas, New Jersey, and Pennsylvania. |

| United Kingdom | 5 Sites | Committed £1.5 billion to UK AI innovation. |

| Europe | 3 Sites | New facilities in Spain and Norway. |

Sources:CoreWeave News, Dgtl Infra

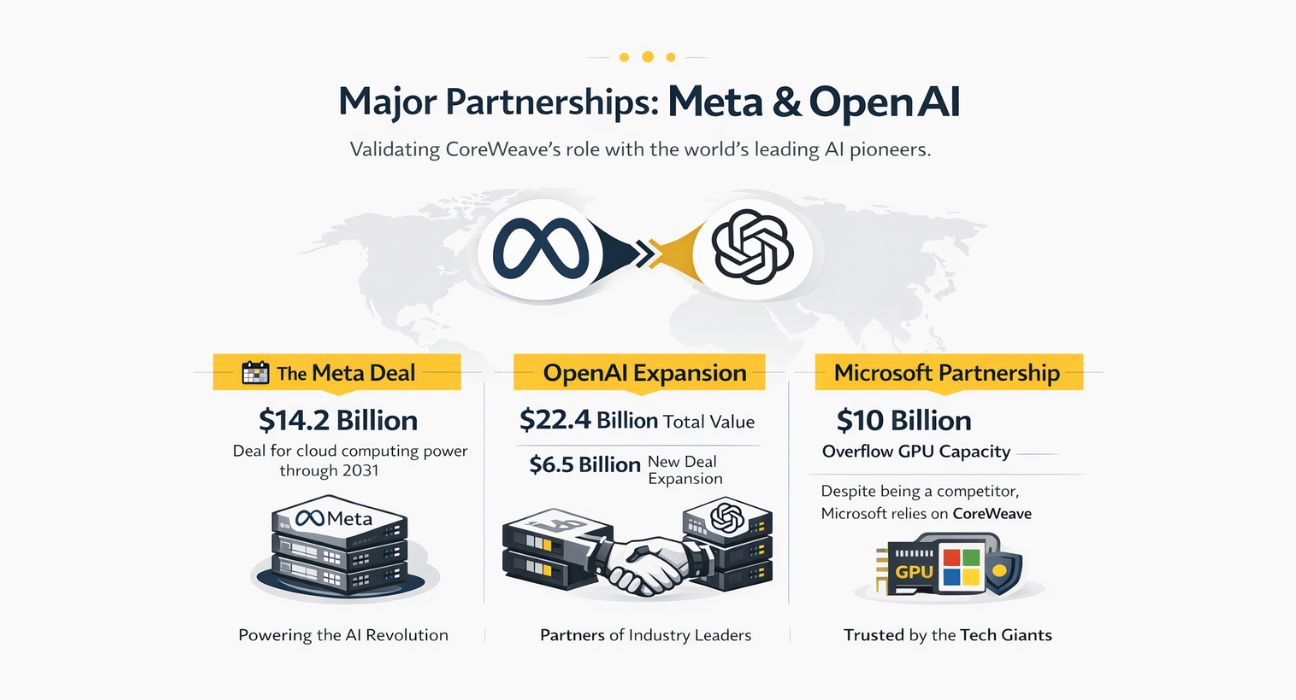

Major Partnerships: Meta & OpenAI

Perhaps the most validating statistic for CoreWeave is its relationship with the world's leading AI pioneers.

- The Meta Deal: In September 2025, Meta signed a $14.2 billion deal for CoreWeave to supply cloud computing power through 2031.

- OpenAI Expansion: CoreWeave expanded its existing partnership with OpenAI by $6.5 billion, bringing their total contract value to a staggering $22.4 billion.

- Microsoft Partnership: Despite being a competitor, Microsoft relies on CoreWeave for "overflow" GPU capacity, a deal worth an estimated $10 billion.

Sources:Nasdaq, The Economic Times

Conclusion

That’s a wrap for my roundup of CoreWeave statistics.

While CoreWeave began as a humble crypto-mining operation in a garage, it has transformed into the critical engine powering the AI boom. With over $55 billion in backlogged contracts and a strategic grip on the world's most valuable hardware, CoreWeave has proven that in the age of AI, specialized infrastructure is king.

Latest Articles

Browse All Articles

- Custom Software

- Feb 16, 2026

Top Software Development Companies for Franchise Businesses (2026)

Looking for the best software development companies for franchises in 2026? Explore our ranked list of top-tier developers building the future of franchise tech.

- Custom Software

- Feb 15, 2026

Top Custom ERP development Companies in Ahmedabad

Explore the top custom ERP development companies in Ahmedabad, offering tailored ERP solutions to streamline business processes, and boost efficiency.